If you're contemplating using your 401(k) savings to fund a home purchase, it's crucial to explore alternative options and consult with a financial expert before making a decision. Before tapping into your retirement funds, careful consideration and expert advice are essential.

The Numbers May Make It Tempting

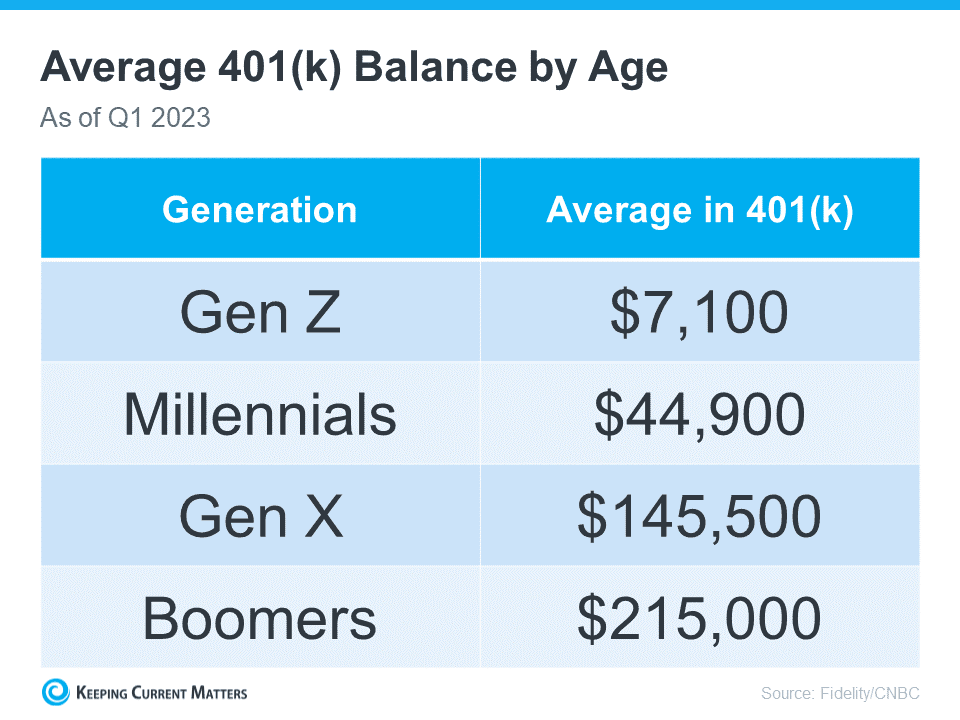

The data indicates that a significant number of Americans have saved a substantial amount for retirement (refer to the chart below).

It may be tempting to use your 401(k) savings for a dream home, but it's crucial to consider potential penalties and long-term financial impacts. Exploring alternative options for saving and home buying is important, as highlighted by Experian.

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Explore various financing options for your home purchase beyond using your 401(k). Experian suggests considering alternative methods before making a decision.

- FHA loans enable eligible buyers to make a down payment as low as 3.5% of the home's price, depending on their credit scores.

- Various national and local programs exist to aid both first-time and repeat homebuyers in securing the required down payment for their homes.

Above All Else, Have a Plan

Before embarking on the journey to homeownership, it's crucial to consult with a financial expert. Success in purchasing a home is contingent on developing a concrete plan, and seeking guidance from a team of experts is recommended. Kelly Palmer, Founder of The Wealthy Parent, emphasizes the importance of this approach.

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

Before tapping into your 401(k) for a home down payment, carefully explore your options and consult with a financial professional to make informed decisions.

For more info and to schedule a meeting, email us at [email protected]