You may have come across recent news reports suggesting that renting is currently more affordable than buying a home. While this may hold true in certain markets when considering monthly payments, it's important to consider one key factor that these reports often overlook: home equity. Let's delve into the significant impact of equity and why it should be a crucial consideration in your decision-making process.

What the Headlines Are Based on

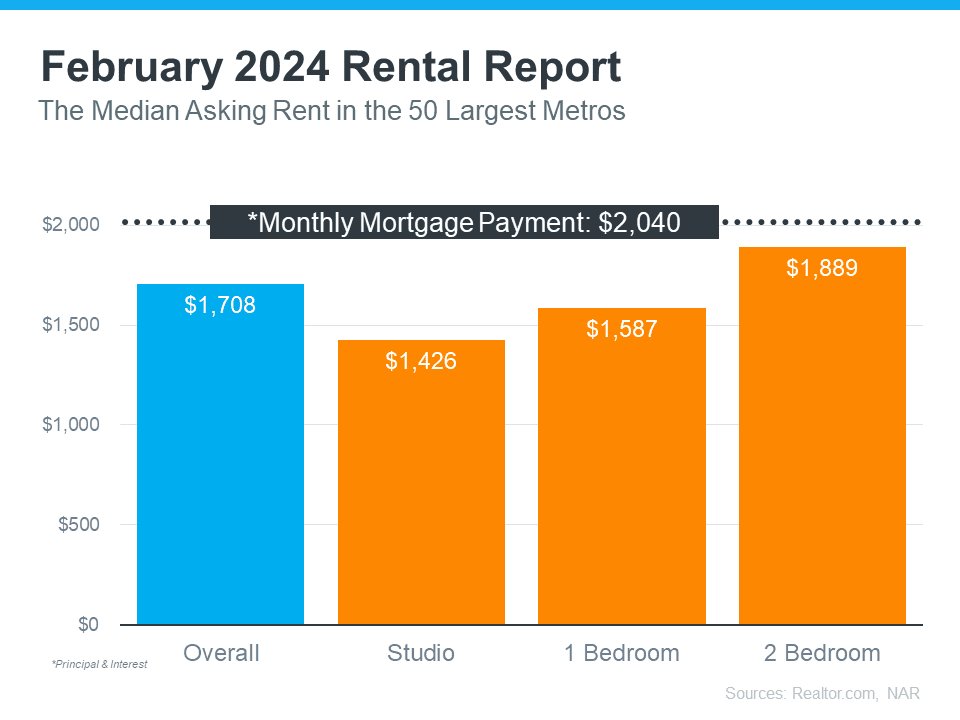

The graph provided below utilizes national data on the median rental payment from Realtor.com and the median mortgage payment from the National Association of Realtors (NAR) to compare the two alternatives. As depicted in the graph, particularly if you're not seeking a large amount of space, renting can be more cost-effective on a monthly basis.

However, if you're in the market for a property with 2 bedrooms, the disparity between the median rent and the median mortgage payment begins to narrow, making it a more manageable difference. The median monthly mortgage payment stands at $2,040, while the median monthly rent for 2 bedrooms is $1,889, resulting in a variance of approximately $151 per month. Yet, it's important to consider the impact of equity as well.

How Equity Changes the Game

When you choose to rent, your monthly payments solely contribute to covering your housing expenses and your landlord's costs. Therefore, aside from potentially saving a bit more each month and receiving your rental deposit back upon relocation, the funds allocated to housing expenses each month are essentially gone for good.

Purchasing a home means that your monthly mortgage payment not only covers your shelter but also serves as an investment. This investment grows in the shape of equity as you make your mortgage payment every month and reduce the amount you owe on your home loan. Furthermore, your equity receives additional growth as home values increase, as they usually do.

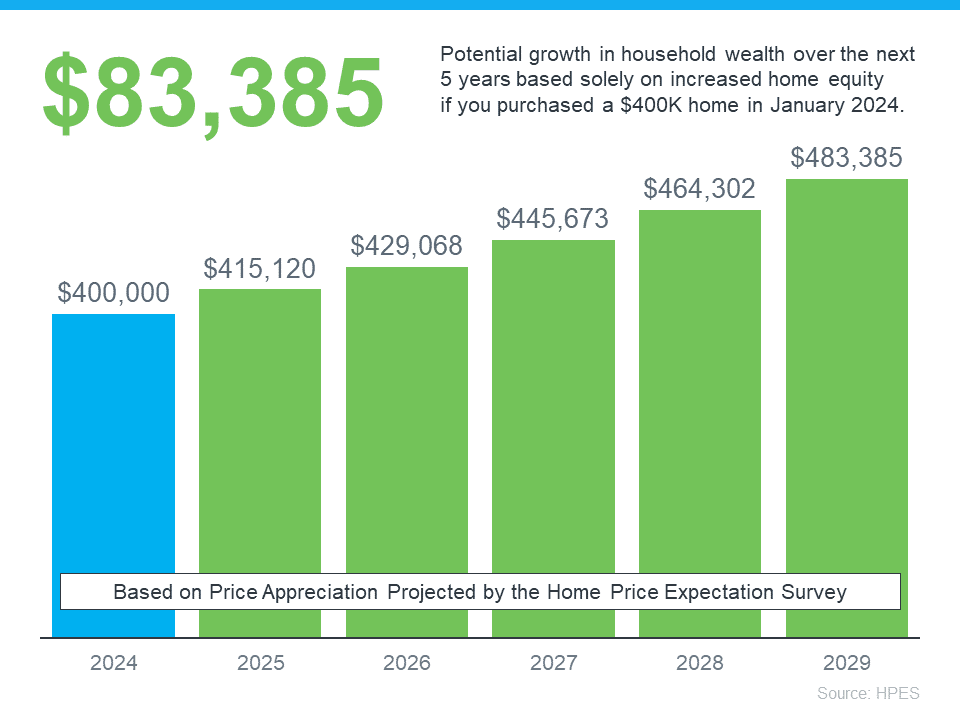

For a more comprehensive understanding of how equity can accumulate rapidly, consider the following data. Every quarter, Fannie Mae and Pulsenomics release the findings of the Home Price Expectations Survey (HPES), which gathers input from over 100 economists, real estate professionals, investment experts, and market strategists regarding their predictions for home prices. In the most recent publication, these experts forecast a continued increase in home prices over the next five years.

Here's an illustration of how equity develops based on the projections from the HPES (refer to the graph below):

Suppose you bought a home for $400,000 at the beginning of this year with the intention of staying for an extended period. According to the HPES projections, if you remain there for 5 years, you could potentially accumulate more than $83,000 in household wealth as your home appreciates in value.

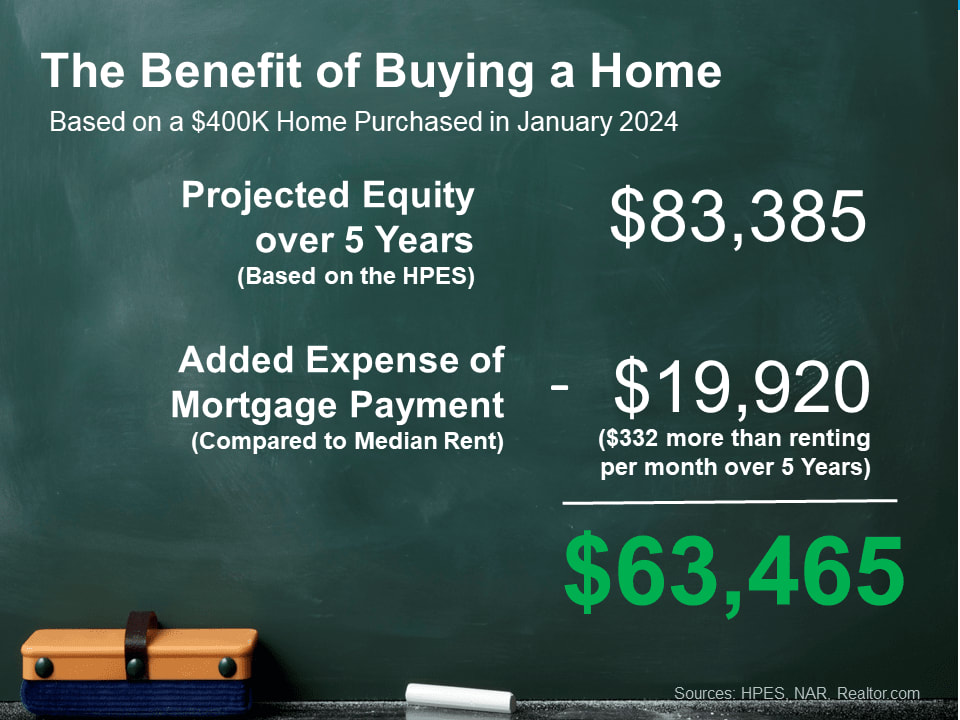

Here's how that compares to renting, utilizing the previously mentioned overall median rent:

Although you might save some money on your monthly payments by renting currently, you will also forego the opportunity to build equity.

So, what's the key insight here? The decision of whether renting or buying makes more sense will depend on your individual financial situation. It's not advisable to purchase a home if the financial calculations truly don't align for you. However, if you are prepared and capable, factoring in equity as the final element may be sufficient to convince you that buying is a more advantageous long-term decision.

Bottom Line

Ultimately, purchasing a home offers a benefit that renting simply cannot provide - the opportunity to build equity. If you are interested in capitalizing on long-term home price appreciation, feel free to reach out to us to discuss your options.

For more info and to schedule a meeting, email us at [email protected]