Introduction:

The housing market has long been a topic of concern, with fears of a potential crash lingering in the minds of homeowners and investors alike. However, recent data paints a different picture, suggesting a stable foundation for the housing market. In fact, a substantial portion of Americans own their homes with impressive levels of equity, hinting at the market's resilience against a drastic crash. This article delves into the reasons behind the current state of Americans' home equity and why it indicates that a residential housing crash might not be on the horizon.

The Landscape of Homeownership:

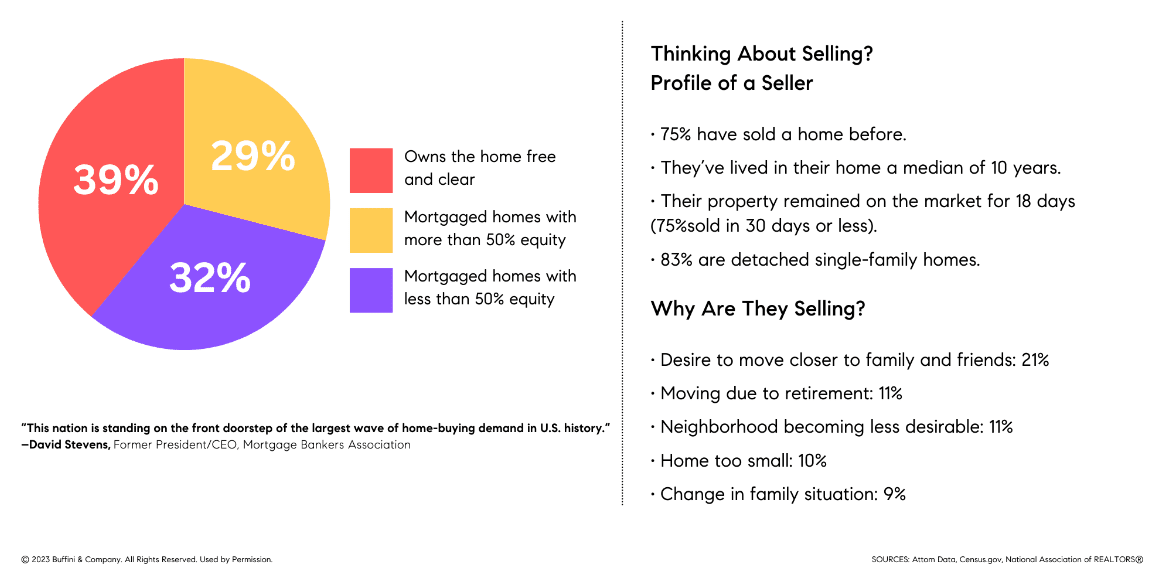

To comprehend the housing market's stability, we need to first examine the distribution of home ownership and the accompanying equity levels. Recent studies reveal a surprising breakdown:

- 39% of homeowners own their homes free and clear of mortgages.

- 29% have mortgaged homes with over 50% equity.

- The remaining 32% hold mortgaged homes with less than 50% equity.

These figures suggest a promising trend that counters the speculation of a housing market crash.

Factors Contributing to Home Equity:

1. Rising Home Prices:

Over the past decade, home prices have experienced a steady increase. This uptick has significantly contributed to equity gains among homeowners. As home values appreciate, homeowners with mortgages benefit from the equity boost.

2.Responsible Lending Practices:

The aftermath of the 2008 financial crisis led to more stringent lending regulations. As a result, homeowners were required to provide higher down payments, leading to better equity positions right from the start of homeownership.

Home Equity as a Buffer:

One of the key reasons the current distribution of home equity is significant is that it acts as a buffer against potential market shocks. Homeowners with substantial equity are more likely to weather financial hardships and economic downturns. This reduces the likelihood of mass foreclosures and fire sales that characterized the 2008 crisis.

Localized Nature of Housing Market:

The housing market is not a monolithic entity but a collection of localized markets. A nationwide crash requires widespread economic disruptions, which are less likely in the present scenario. While certain regions might experience fluctuations, the overall market is more resilient due to its decentralized nature.

Conclusion:

The prevailing distribution of home equity among Americans provides a compelling argument against the possibility of a residential housing crash. With a significant percentage of homeowners owning their homes free and clear or with substantial equity, the housing market is well-positioned to withstand potential shocks. Factors such as rising home prices, responsible lending practices, and low mortgage rates have all contributed to this stable foundation. While localized variations might occur, evidence suggests that a nationwide housing market crash is not imminent. Investors, homeowners, and policymakers can take solace in these figures, knowing that the current housing market is more robust than speculative fears suggest.